What to do about Inflation . . .

Are you worried about Inflation?

The past few weeks' headlines have focused on inflation causing volatility and uncertainty in the stock market. My last newsletter ended by asking, how can someone lose money through saving?

During Christmas and Thanksgiving conversations revolved around gas, food, and home prices. My mom is wanting to move cities next year, and she is concerned that these items are far more expensive and less available now than 5 years ago. Especially, as she plans to retire. Inflation is much more punishing for the middle class because the majority of their income each month goes to housing, food, and gas.

CNBC ran this article right before Thanksgiving.

If it takes more dollars to buy the same goods and services, the important questions are why and what can we do about it.

Why?

The why behind inflation is complicated to unpack, however, it’s important we keep it simple. There are economists, investors, historians, and scholars who have written books dedicated to understanding inflation.

If you are looking for a deeper dive a good book that on how America got here is “Lord’s of Finance” by Liaquat Ahamed. I am not going to recap several hundred years of history. The simple way to understand inflation today is to know the world has gone through 2 major phases of trading goods and services.

Phase 1, often considered primitive, is where goods and services were exchanged directly. For example, 1 cow might equal 50 chickens at the market.

Phase 2, is the world we live in today. People use the money to exchange goods and services. If you want a deep dive on “what is money” I suggest you check out a great interview done by an MIT scholar named Lex Fridman with Robert Breedlove. They cover “What is Money” at 1:39:54 in this interview.

“Lords of Finance” explains since World War II governments have used the US dollar for settling trade internationally. The book also outlines the history of the Federal Reserve which was chartered to “control” the United States and the world’s economies. This control comes at a price. Remember your parents telling you there is no such thing as a free lunch? Change is inevitable and the principles for wealth preservation with money started to change in 1971. The US could no longer honor the promise that $35 = 1 oz of gold. By changing that rule (which was defaulting on a promise from Bretton Woods) the US was able to print as many dollars as they needed. The US Dollar was no longer backed by anything tangible. The world shifted into a faith-based economy that the US Government would always honor the debts associated with its currency. When Nixon made this announcement, it was sold as a requirement to save the US economy via the news. The US Government’s faith-based economy said they would always honor a debt in US dollars they just didn’t commit to maintaining the value of those dollars.

To understand how the supply of dollars is always increasing you will need to understand how they are created through US commercial banks. The important piece to know is that dollars (also known as M2 money supply) are created by banks. If you are interested in learning how this works, George Gammon has a great YouTube series that explains how these dollars get created and distributed throughout the economy. I find his videos highly educational and informative. Here is a link that describes how this process works.

The summary here is that when the world changes we must adapt to those changes. Change is hard and it’s difficult to follow in politicized news coverage. The result of the changes that have taken place over the last 100 years is that individuals can no longer simply save dollars for a rainy day. The longer you save your money the more dollars get created causing you to lose the purchasing power of your dollar. That is inflation and it’s bad! It’s not hard to recognize once you know what to look for. Look back at the price of gold in US dollars:

Why does the same ounce of gold cost so much more today than it did in 1977? There have been small shifts in the supply and demand of gold however the real reason is that there are more dollars chasing the same ounces of gold. The other way to think of this is to visualize buying a nice suit in 1971. You could buy that suit for about $100 today that same suit cost about $2000. Regardless of what year you buy the suit, you could pay for it with 1 oz of gold however if you saved your dollars in 1972 there is no way you could afford the suit today. This is why you hear folks advocating for buying gold and bitcoin.

The Federal Reserve’s website shows the money supply (M2) back to 1959. It’s far enough that we can see the correlation to the prices of the goods and services we purchase every day. This is the visual that shows when you have more dollars chasing the same amount of goods and services it takes more dollars to purchase them.

We can see the price of gold skyrocket when the US started printing more and more dollars. This printing of more and more dollars is what makes your savings decrease in value.

If you are collecting a paycheck and you are not getting a 7% raise every year, your dollar will purchase fewer goods and services next year. Which is why financial news companies are printing headlines like this.

What Can You Do About it?

Connecting the dots through education is the first step. This will prepare you to act. The best way to protect and grow your wealth is through multiple streams of diversified income. This is exactly why experts like Robert Kiyosaki claim “Savers are Losers”. What individuals cannot control is the policies and decisions governments make, however engaged individuals can grow and protect their wealth through diversification by owning gold, real estate, bitcoin, and cash flowing assets which hold their value. The below diagram can help you identify where you are at on the path to financial freedom.

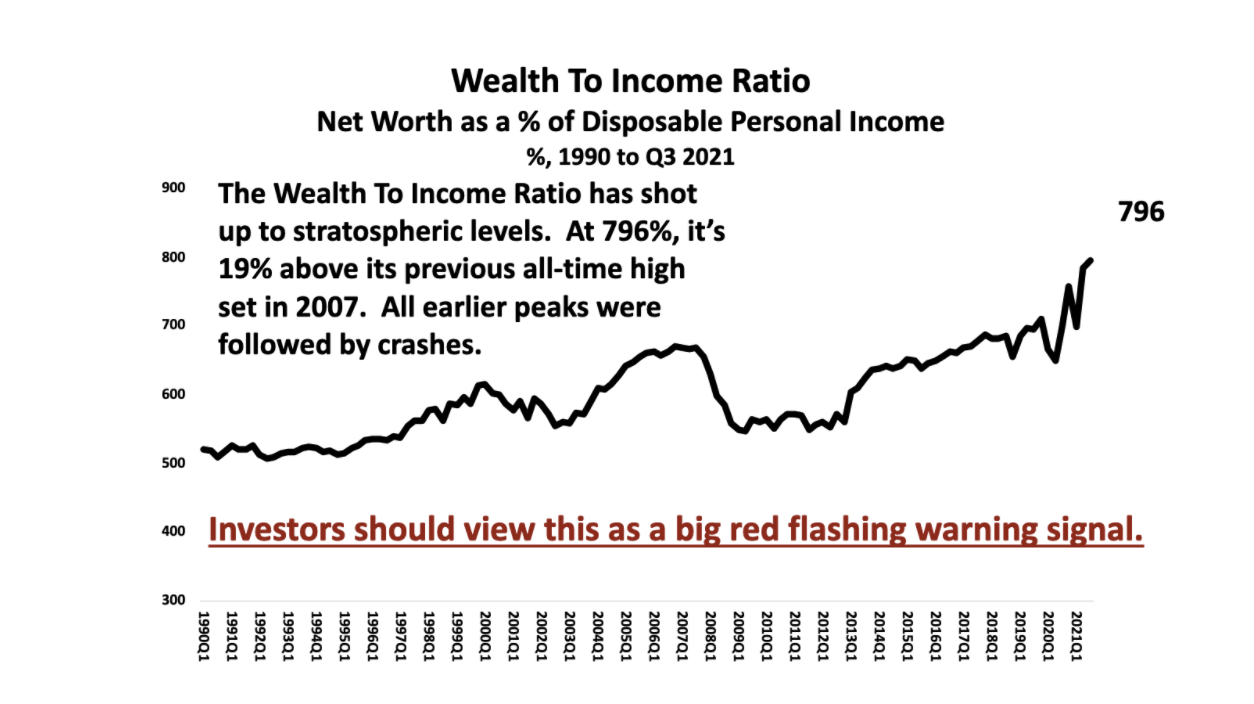

There is more wealth in the US today than ever before.

Chart is taken from RichardDuncanEconomics.com

Make sure you are investing in yourself and a team to grow and preserve it. Don’t get overwhelmed, taking a small step each month can make a big difference. Start today by investing in your education, find a cash flow club, and building a balance sheet and cash flow statement. Diversify some of your retirement accounts into real assets throughan eQRP. If you get stuck or have questions don’t hesitate to reach out. It’s my mission at BMD Investment Group to support investors along this journey!

In January I will share our 2022 outlook and a notes from 2021. Until next time have a safe and happy New Year!